Global & India Markets Today: Record Highs, Profit Booking & Sector Plays

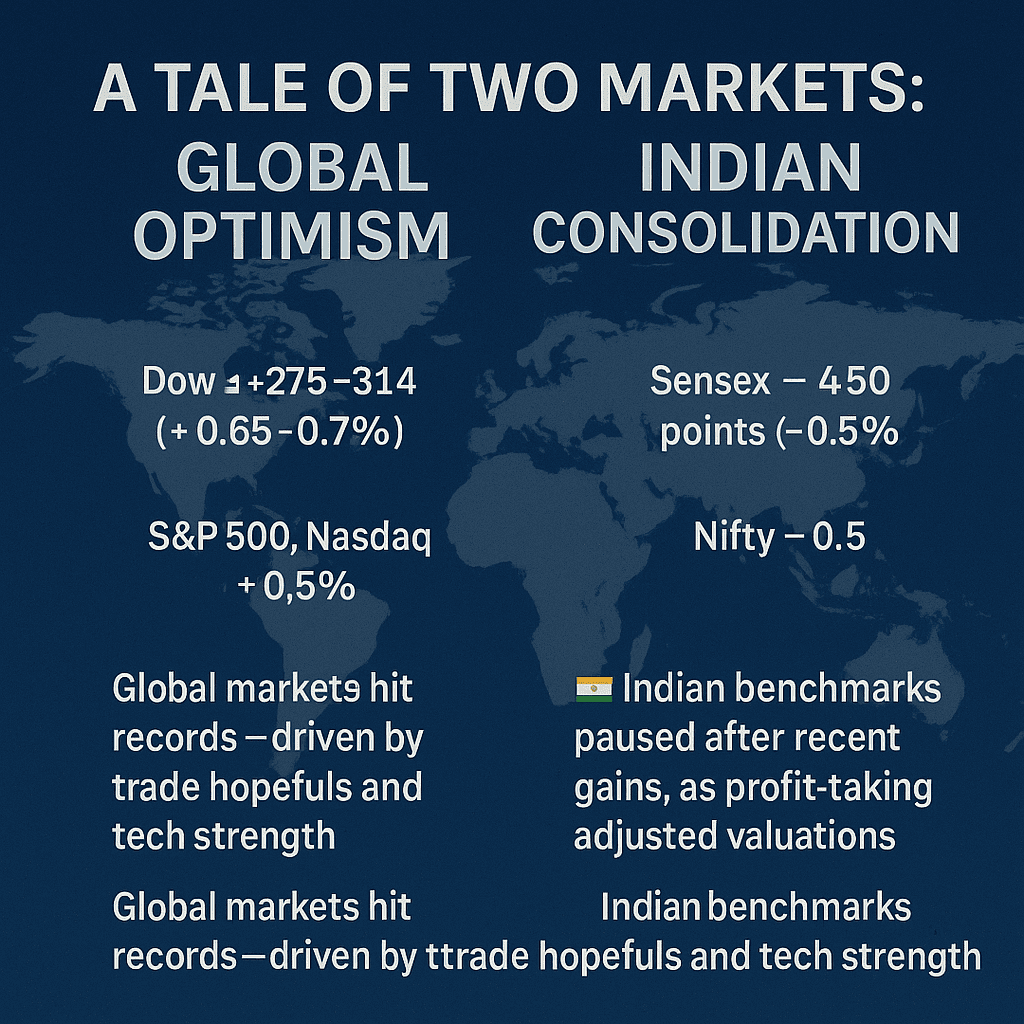

A Tale of Two Markets: Global Optimism vs. Indian Consolidation

Markets across the globe painted a picture of cautious optimism today. The U.S. stock market extended its bull run: the Dow recorded a gain of ~275–314 points (+0.6–0.7%), while the S&P 500 and Nasdaq both pushed to fresh record highs (+0.5%) on renewed hopes of trade deck progress—most notably Canada’s withdrawal of a digital services tax and rumored easing of tariffs with China and India. Tech giants—Apple, Microsoft, Nvidia—led the charge, even as bond yields ticked up ahead of the U.S. JOLTS jobs report .

Meanwhile, Asian markets followed suit, rising amid easing geopolitical tensions and mixed economic data, while oil prices retreated on OPEC+ production signals . Investors balanced upbeat growth forecasts with caution over potential tariff cliffs looming in early July.

🇮🇳 India Snapshot: Profit-Taking Amid Foreign Inflows

On Dalal Street, action was more subdued. The Sensex fell ~450 points (0.54%) to 83,606, while the Nifty closed near 25,517 (-0.47%). After a thrilling four-day rally, investors booked gains in banking and auto stocks, dragging benchmarks lower. PSU banks bucked the trend, surging ~2½% as metal and small/mid-cap segments held steady.

Heavyweights like HDFC Bank (-0.8%), Axis Bank, and Kotak saw profit-related dips. Torrent Pharma and Alembic Pharma rallied (+4–5%) following regulatory news, while ITD Cementation climbed on a major overseas contract. Karnataka Bank dropped 7% after top-level resignations, while the rupee weakened to ₹85.75/$—aided by RBI’s strategic short-dollar adjustment.

What’s Driving the Divergence?

- Global vs. Local triggers: U.S. markets surge on trade optimism; India halts to reset post-rally.

- Sector rotation: India’s profit-taking in finance/auto and shift to PSU banks and pharma suggests tactical rebalancing.

- Macro watchlist: Eyes on July 9 U.S. tariff deadline, job openings report, and India’s PMI/IIP data for next direction.

What Lies Ahead

- For India: Levels to watch are Nifty at 25,300–25,500 support, and upside potential to 25,800–26,000 if global sentiment holds.

- Globally: Trade deals and U.S. labor data could either boost or cap the rally—bond yields remain a key risk indicator.

- Market mood: Seasonal consolidation in India, while global equity optimism rides on dovish expectations.

Key Takeaways

- Global markets hit records—driven by trade hopefuls and tech strength.

- 🇮🇳 Indian benchmarks paused after recent gains, as profit-taking adjusted valuations.

- Sector dynamics: India shifts from large-cap auto/finance to PSUs, small/mid-caps, and pharma winners.

- Eyes on U.S. tariff decisions, job data, and India’s industrial indicators.